Below are some activities that can be supported:

- production and processing activities

- development and innovation activities

- development of new and significant improvements to existing products, production batches, manufacturing processes and production technologies

- business support activities

- customer / customer relationship centers, centers of separate business activities (finance, accounting, marketing, product design, audiovisual, human resources development and information technology development)

- activities of high value added services

- creative services activities (architecture, design, media communication, publicity, publishing, culture, creative industry and art)

- activities of catering and tourism services (projects of catering and tourist accommodation facilities, four or five star categories, types: hotel, aparthotel, tourist resorts and camps, heritage hotel, diffuse hotel, supporting projects of all the above mentioned types of accommodation facilities, health projects, congress, nautical, cultural, golf tourism, entertainment and / or recreation centers and theme parks, tourism-ecological projects and other innovative projects in high value-added tourism

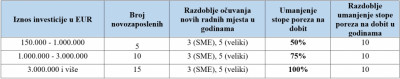

Tax incentives:

|

Investment u EUR |

Number of new employees |

Job retention period in years |

Decrease in income tax rates |

Income tax reduction period in years |

|

150.000 - 1.000.000 |

5 |

3 (SME), 5 (big) |

50% |

10 |

|

1.000.000 - 3.000.000 |

10 |

3 (SME), 5 (big) |

75% |

10 |

|

3.000.000 i više |

15 |

3 (SME), 5 (big) |

100% |

10 |

The maximum incentive amount is:

- 45% investment for small businesses

- 35% investment for medium-sized enterprises

- 25% investment for large companies

Example for a medium-sized company:

Investment amount: HRK 10,000,000 (tax reduction 75% from 18% to 4,5%).

Incentive amount: HRK 3,500,000 (35%).

Profit: HRK 4,000,000 per year and 18% income tax of HRK 720,000.

Impact of using incentives: 75% reduction in income tax - HRK 540,000 less tax is paid and the maximum incentive amount of HRK 3,500,000 is reached in 6.5 years.

For more information, please contact.